In order to prepare a budget and understand what initial investments, costs and revenues will be involved, it is important to prepare a detailed plan regarding the type of business to be created, particularly as concerns the following:

- the range and quantity of products to be offered

- positioning, image and marketing style

- the quality, cost and price of the products

- the type and size of the shop and amount of seating

- the location of the shop

- the equipment needed

- the personnel needed to run the new business.

These decisions will determine the success or failure of the business as well as the level of the related investment, costs and revenues.

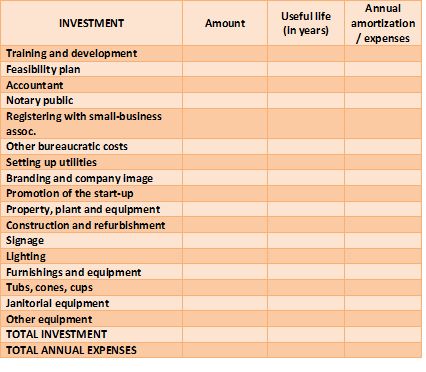

An analysis of investments is needed in order to determine the initial amount that will need to be spent on property, plant, equipment and intangible assets in order to start up the business and the related amount of depreciation and amortization that will be recognized each year based on the expected useful life of each investment.

The main aspects needed in order to define the investment plan are:

- the intangible assets, such as goodwill, legal and accounting expenses to start up the business, registering trademarks, setting up utilities, the marketing campaign for the start-up, other initial marketing advisory services, etc.;

- the property, plant and equipment needed, including furnishings, computers, and so on.

An income statement format will then be used to forecast the revenues of the business and the profit or loss that is expected for the first few years of the business. In order to do this, it will be necessary to have on hand all of the information related to the products that the business will provide, the market to be served, and the facilities to be used. Only with all of this information will it be possible to make a forecast of annual operating costs, revenues and earnings.

Some of these costs will vary in direct proportion to the volume of product sold, and these are referred to as variable costs. These include costs for the purchase of product ingredients and other raw materials, ice-cream cones and cups, and toppings. Other costs will need to be incurred regardless of the volume of product sales, and these are called fixed costs. These include depreciation and amortization, employee salaries, lease payments, etc. Finally, certain costs have both fixed and variable components, such as costs to maintain the business’s plant and equipment. Given that the amount of such expenses is not high, for the sake of simplicity they are often included among fixed costs.

Another important aspect, which is not easy to determine for a start-up, is the forecast of revenues. In order to estimate the revenues for the first and second year of business, a number of sources of information can be used:

- other similar businesses (gelato makers), which may be willing to offer some advice;

- ingredients’ companies, which have experience that comes from managing relations with numerous other gelato makers;

- industry associations, which are often managed by people with a great deal of experience in the industry.

By comparing the expected costs with these revenue forecasts, the business’s expected operating income can be determined as follows:

OPERATING INCOME = ANNUAL REVENUES - TOTAL OPERATING EXPENSES (i.e. FIXED COSTS + VARIABLE COSTS + DEPRCIATION & AMORTIZATION)

Calculated in this way, this operating income includes the remuneration of the owner and various partners in the business, as this is not included among the fixed costs. It also does not take account of value-added tax (VAT), given that the cost and revenue figures used include VAT, and it is before the deduction of any income taxes.

In order to determine the business’s net income after taxes, the various taxes and withholdings to be paid (income taxes, social security withholdings, and so on) need to be deducted. Therefore, it may be a good idea to have the help of an accountant in order to create a more precise estimate of the revenue and income that the business could generate.

A sample investment plan

In order to understand all of this better, shown below is template of a typical initial investment that could be required in order to start up this type of business. The figures are not shown as they will be different country by country. Same for useful life and the annual amortization.